- 台股

- 新聞

- 訂閱電子報

專家讓您懂 |

投資講座 |

|

|

||

基金新聞 |

推薦新聞 |

點閱排行 |

你的新聞 |

|

|

||||

| 淨值日期 | 最新淨值 | 漲跌 | 漲跌幅% | 52周最高 | 52周最低 |

|---|---|---|---|---|---|

| 2025/11/03 | 97.2400 | ▼0.53 | ▼0.54 | 102.3400 | 79.0500 |

基金走勢 |

基金快遞 |

| 基金公司 | 富蘭克林證券投資顧問(股)公司 | ||

| 淨值 (2025/11/03) |

97.24000 | 計價幣別 | 美金 |

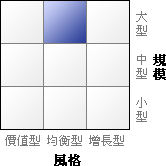

| 基金類別 | 美國大型均衡型股票 | ||

| 本年迄今收益% | 9.90 | 基金規模(百萬) (2024/04/30) |

18,392.98 |

| 申購手續費率 | --% | 買回手續費率 | --% |

| 基金管理費率 | 0.75% | 基金保管費率 | 0.00% |

資產配置 |

截至:2025/09 |

風險評估 |

| 標準差 | 夏普值 | Beta值 | Alpha值 | |

| 一年 | 11.13% | 0.51 | 0.83 | -6.80 |

| 三年 | 11.44% | 0.66 | 0.81 | -4.87 |

| 五年 | 14.73% | 0.64 | 0.88 | -2.81 |

| 十年 | 14.48% | 0.68 | 0.91 | -1.57 |

行業比重 |

截至:2025/09 |

| 行業類別 | 百分比% |

| Software | 17.06 |

| Semiconductors | 10.66 |

| Medical Devices & Instruments | 7.39 |

| Capital Markets | 6.21 |

| Chemicals | 6.02 |

| Drug Manufacturers | 5.23 |

| Retail -Cyclical | 4.75 |

| Aerospace & Defense | 4.06 |

| Hardware | 3.55 |

| Credit Services | 3.18 |

| Banks | 3.15 |

| Industrial Products | 3.07 |

| Consumer Packaged Goods | 2.89 |

| Construction | 2.88 |

| Retail - Defensive | 2.74 |

| Oil & Gas | 2.67 |

| Restaurants | 1.96 |

| Conglomerates | 1.55 |

| Insurance | 1.54 |

| Business Services | 1.49 |

| Industrial Distribution | 1.34 |

| Beverages - Non-Alcoholic | 1.22 |

| Asset Management | 1.18 |

| Utilities - Regulated | 0.98 |

| Medical Diagnostics & Research | 0.88 |

| Homebuilding & Construction | 0.68 |

| Manufacturing - Apparel & Accessories | 0.44 |

前十大持股 |

截至:2019/09 |

| 投資標的 | 資產百分比% |

| MICROSOFT CORP | 6.85 |

| ROPER TECHNOLOGIES INC | 5.96 |

| STRYKER CORP | 4.17 |

| ACCENTURE PLC | 3.69 |

| HONEYWELL INTERNATIONAL INC | 3.60 |

| LINDE PLC | 3.57 |

| TEXAS INSTRUMENTS INC | 3.45 |

| AIR PRODUCTS & CHEMICALS INC | 3.41 |

| BECTON DICKINSON AND CO | 3.40 |

| MEDTRONIC PLC | 3.15 |

基金速覽 |

||||||||||||

|

淨值美金

97.2400

▼0.54%

|

||||||||||||

過去績效 |

資料日期:2025/11/03 |

|||||||||||

|

||||||||||||

基準指數 |

||

|

基金指數 Morningstar 基準指數 |

||

Moningstar 風格箱 |

熱門點閱排行 |

||

你的最愛 |

||

最近點閱 |

||||||||

|

||||||||

看此基金的人也看了 |

||