- 台股

- 新聞

- 訂閱電子報

專家讓您懂 |

投資講座 |

|

|

||

基金新聞 |

推薦新聞 |

點閱排行 |

你的新聞 |

|

|

||||

| 淨值日期 | 最新淨值 | 漲跌 | 漲跌幅% | 52周最高 | 52周最低 |

|---|---|---|---|---|---|

| 2025/11/03 | 3.2660 | ▲0.018 | ▲0.55 | 3.2950 | 2.2310 |

基金走勢 |

基金快遞 |

| 基金公司 | 利安資金管理有限公司 | ||

| 淨值 (2025/11/03) |

3.26600 | 計價幣別 | 新加坡幣 |

| 基金類別 | 大中華股票 | ||

| 本年迄今收益% | 32.07 | 基金規模(百萬) (2025/09/30) |

428.66 |

| 申購手續費率 | 5.00% | 買回手續費率 | 1.00% |

| 基金管理費率 | 1.25% | 基金保管費率 | 0.05% |

資產配置 |

截至:2025/09 |

風險評估 |

| 標準差 | 夏普值 | Beta值 | Alpha值 | |

| 一年 | 20.58% | 1.47 | 1.30 | -5.93 |

| 三年 | 22.14% | 1.01 | 1.08 | -1.36 |

| 五年 | 21.67% | 0.41 | 1.06 | -0.53 |

| 十年 | 18.99% | 0.49 | 1.07 | -0.94 |

行業比重 |

截至:2025/09 |

| 行業類別 | 百分比% |

| Semiconductors | 23.87 |

| Interactive Media | 12.42 |

| Retail -Cyclical | 11.91 |

| Hardware | 11.88 |

| Industrial Products | 5.45 |

| Banks | 5.35 |

| Insurance | 4.34 |

| Vehicles & Parts | 3.92 |

| Real Estate | 3.76 |

| Metals & Mining | 3.31 |

| Capital Markets | 3.06 |

| Travel & Leisure | 2.22 |

| Biotechnology | 1.53 |

| Software | 0.90 |

| Oil & Gas | 0.85 |

| Credit Services | 0.46 |

| Beverages - Non-Alcoholic | 0.26 |

| Beverages - Alcoholic | 0.21 |

| Medical Diagnostics & Research | 0.15 |

| Furnishings, Fixtures & Appliances | 0.10 |

| Forest Products | 0.00 |

前十大持股 |

截至:2022/12 |

| 投資標的 | 資產百分比% |

| Taiwan Semiconductor Manufacturing Company Limited | 11.88 |

| Tencent Holdings Limited | 9.62 |

| Alibaba Group Holding Limited | 5.30 |

| AIA Group Limited | 4.79 |

| Meituan | 2.85 |

| JD.Com Inc. | 2.84 |

| Ping An Insurance (Group) Company of China Limited H Shares | 2.03 |

| Mediatek Inc. | 1.95 |

| China Shenhua Energy Company Limited H Shares | 1.95 |

| Longfor Group Holdings Limited | 1.89 |

基金速覽 |

||||||||||||

|

淨值新加坡幣

3.2660

▲0.55%

|

||||||||||||

過去績效 |

資料日期:2025/11/03 |

|||||||||||

|

||||||||||||

基準指數 |

||

|

基金指數 Morningstar 基準指數 |

||

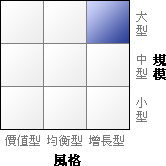

Moningstar 風格箱 |

熱門點閱排行 |

||

你的最愛 |

||

最近點閱 |

||||||||||||||||||||

|

||||||||||||||||||||

看此基金的人也看了 |

||